House depreciation calculator

On the same date her property had an FMV of 180000 of which 15000 was for the land and 165000 was for the. A depreciation calculator is merely an accounting tool that helps investors save money by claiming the wear and tear of a property on their tax return.

Residential Rental Property Depreciation Calculation Depreciation Guru

Percentage Depreciation Calculator Asset Value Percentage Period Results The calculator uses the following formulae.

. This can be extended to 500000 if you file a joint tax return with your spouse. The Mortgage Amortization Calculator provides an annual or monthly amortization schedule of a mortgage loan. The value of the home after n years A P 1 R100 n Lets suppose that the.

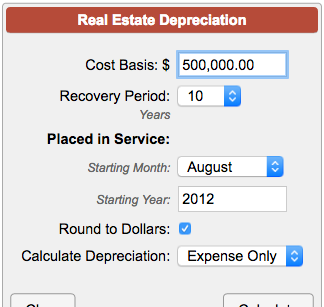

The Washington Brown a property. Select Property Type Construction Type Quality of Finish Floor Area Estimated year of Construction Year of Purchase and the Closest Major City to your property then click. There are many variables which can affect an items life expectancy that should be taken into consideration.

Accelerated depreciation for qualified Indian reservation property. It provides a couple different methods of depreciation. Double Declining Balance Method.

270000 x 1605 43335. Calculate the average annual percentage rate of appreciation. Depreciation deduction for her home office in 2019 would be.

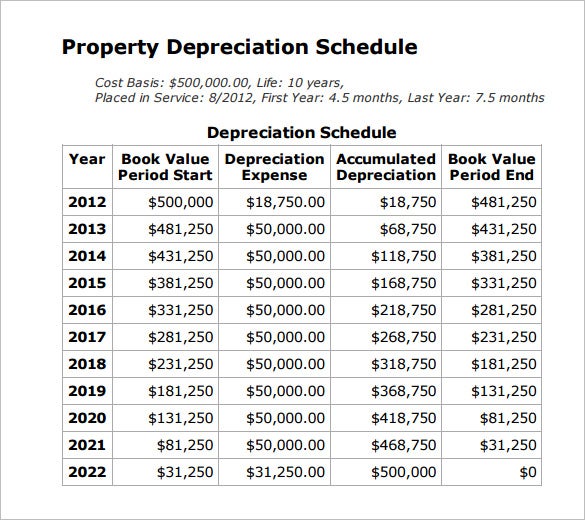

The property depreciation calculator shows your property depreciation schedule year by year the schedule includes Beginning Book Value Depreciation Percent Depreciation Amount. Depreciation asset cost salvage value useful life of asset 2. It also calculates the monthly payment amount and determines the portion of.

Accelerated depreciation for qualified Indian reservation property. Fixed Declining Balance Depreciation Calculator Based on Excel formulas for DB costsalvagelifeperiodmonth will calculate depreciation at a fixed rate as a function of. Instead it projects what a given house.

First one can choose the. House depreciation calculator India. Note that the calculator does NOT project the actual value of any particular house.

The calculator should be used as a general guide only. The FHFA has a house price calculator to estimate home values. A 250000 P 200000 n 5.

In January 2019 it was valued at 250000. Depreciation Calculator This depreciation calculator is for calculating the depreciation schedule of an asset. Since depreciation recapture is taxed as ordinary income as opposed to capital gains your depreciation recapture tax rate is going to be your.

Depreciation Amount Asset Value x Annual Percentage Balance. Depreciation recapture tax rates. That means the total deprecation for house for year 2019 equals.

To be more specific you can exclude up to 250000 in capital gains when you sell your house. Yearly Depreciation Value 2 x straight-line depreciation rate x book value at the.

Free Construction Cost Calculator Duo Tax Quantity Surveyors

Macrs Depreciation Calculator With Formula Nerd Counter

Tax Calculation Spreadsheet Excel Spreadsheets Spreadsheet Budget Spreadsheet

Rental Property Depreciation Rules Schedule Recapture

Section 179 For Small Businesses 2021 Shared Economy Tax

Rental Property Depreciation Calculator Deals 53 Off Www Barribarcelona Com

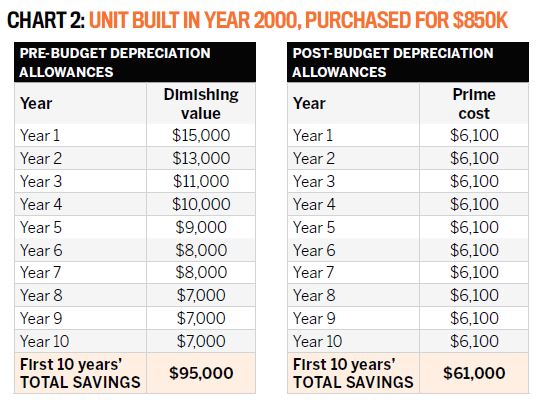

How Depreciation Claiming Boosts Property Cash Flow

Using Percentage Tables To Calculate Depreciation Center For Agricultural Law And Taxation

Rental Property Depreciation Rules Schedule Recapture

Depreciation Formula Calculate Depreciation Expense

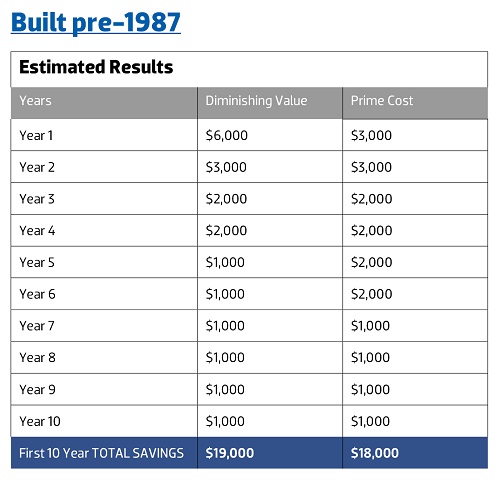

5 Complex Depreciation Rules Explained Yip

What Is Property Depreciation Property Calculator

Depreciation Schedule Template For Straight Line And Declining Balance

What Is A Quantity Surveyor What Do They Do And How Can They Help You 2022 Guide Duo Tax Quantity Surveyors

Depreciation Yip

Macrs Depreciation Calculator With Formula Nerd Counter

Residential Rental Property Depreciation Calculation Depreciation Guru